Cracking the Code: The 6 Most Important Numbers for Car Lease Calculations

9/8/2025

Cracking the Code: The 6 Most Important Numbers for Car Lease Calculations

Leasing a car can feel like walking into a maze of numbers, acronyms, and fine print. As someone who hacked my first lease and saved over $7,000, I know firsthand how confusing these calculations can be—and how powerful it feels once you truly understand them.

Once you crack the code behind lease math, the mystery fades and you gain the upper hand in every negotiation. Let’s break down car lease math step-by-step, so you can go from overwhelmed to confident, whether you’re using a car lease website, working with a car lease broker, or lease hacking your own deals.

Why Lease Math Feels So Confusing

Most drivers walk into a dealership with only one number in mind: the monthly payment. But that number is the result of many different numbers and calculations. Dealers and salespeople know this, which is why they focus on monthly cost while avoiding the actual math.

If you can understand the core elements, you’ll gain control of the conversation and unlock the same leverage leasehackers use to score incredible deals.

The confusion usually comes from how dealers bundle the numbers together. Taxes, acquisition fees, disposition fees, documentations fees, and even subtle markups on the money factor all get rolled into the “easy” monthly number. If you don’t pull the numbers apart, you’ll never see where the dealer is padding the profit. By breaking it down step by step, you can see exactly where your money is going.

Many people never look beyond the payment, which is exactly what dealers want. This is why so many shoppers leave the dealership scratching their heads, unsure of why their $350/month “deal” suddenly looks like $420/month once the paperwork is printed. Knowledge of the structure behind those payments flips that script entirely.

The Core Components of a Lease Calculation

Every car lease is heavily dependent on six core components. If you pick a car with good numbers for these components, you will be able to get a good lease deal.

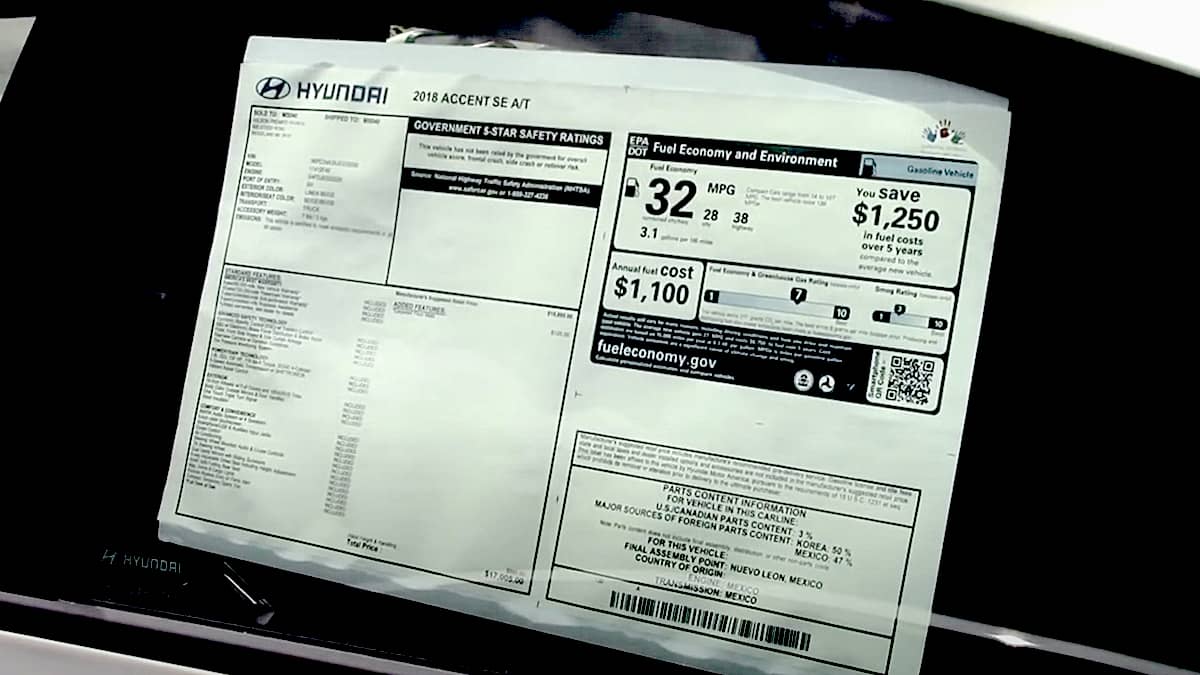

1. MSRP (Sticker Price)

This is the manufacturer’s suggested retail price. Think of it as the starting line. The residual value which is another core component, is dependent on the MSRP.

Window Sticker with MSRP

2. Selling Price

The agreed-upon price of the car, after negotiations. This is one of the most important numbers you can control as a leasehacker. The lower the selling price, the less you’re financing.

A smart strategy is to treat this exactly as you would if you were buying the car, try to get the biggest discount you can from the dealer.

A tip for this is to go to truecar.com and see the average discount buyers are getting on the car you are looking for.

Another tip is to search google for "slowest selling cars" and see what cars are on the list, these almost certainly will be easy to get discounts on.

Think of the depreciation you have to pay which is what car lease math is all about, as the difference between the selling price and the residual value, if you can get the selling price lower, you will pay less depreciation and have lower monthly payments.

3. Residual Value

This is what the leasing company predicts the car will be worth at the end of your lease term. It’s expressed as a percentage of MSRP. For example, if a $40,000 car has a 60% residual after 36 months, that’s $24,000. Higher residual = lower monthly payments. The key detail: residual values aren’t negotiable. They’re set by the bank or leasing company, so your job is to pick a car model that naturally holds strong residuals. Vehicles with a history of high resale value—like certain SUVs and EVs—tend to make better leases.

4. Money Factor (MF)

Think of this as the interest rate for your lease. Instead of APR, leasing companies use a decimal number. To convert it into an approximate APR, multiply by 2,400. For example, a money factor of 0.00125 equals ~3% APR. Dealers often mark up the MF to make hidden profit. If you know the base rate offered by the bank, you can push to get that instead of the inflated version. Even a small bump in MF can cost you thousands over a three-year lease.

But here’s the catch: residual values, money factors, and many of the incentives that impact your lease aren’t publicly available. They’re controlled by banks and leasing companies, and dealers don’t exactly volunteer them upfront. This lack of transparency is why most people walk away unsure if they got a good deal or not.

Here at LeaseFilter, we solve this problem by giving you access to all the numbers that actually matter—residuals, money factors, and current incentives—so you can see the full picture. Instead of guessing or relying on whatever the dealer tells you, you know exactly what inputs are driving your lease payment. That transparency is what enables you to lease hack and turn down bad deals.

5. Incentives

Incentives are bonuses or rebates provided by the manufacturer or lender to encourage leasing certain vehicles. These can include cash rebates, loyalty bonuses, conquest bonuses, or federal and state EV tax credits that are passed through in the lease. Incentives can slash thousands off the effective lease cost, but they are often regional and time-sensitive, making them difficult for the average shopper to track.

The easiest free way to find some of these incentives is to go to the manufacturer's website and look at their lease deal incentives.

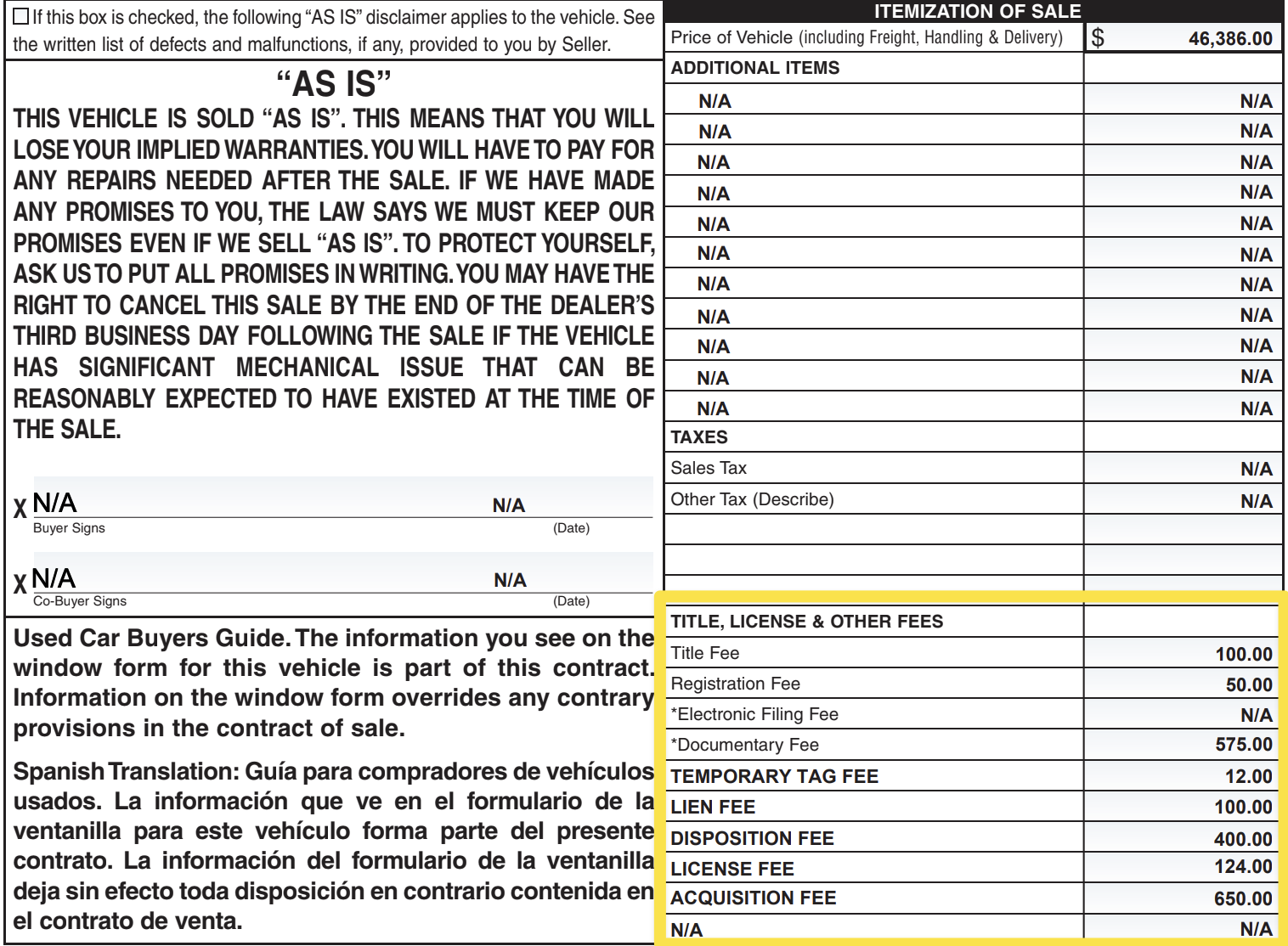

6. Fees

Fees are the quiet killers of good lease deals. Acquisition fees, disposition fees, and dealer documentation fees are common. Some are mandatory like disposition and acquisition fees, but many are padded or inflated by the dealer.

Add-ons like GAP insurance, window etching, or tire protection packages can quietly increase your monthly payment without adding real value.

Understanding which fees are legitimate and which can be negotiated or removed is critical to protecting your savings when lease hacking.

Real lease contract with the fees section highlighted

Why EVs are typically strong lease deals

Take a $50,000 EV. On paper, you might assume the lease would be pricey. But because manufacturers want to move EVs, they stack on heavy incentives (like the $7,500 tax credit), dealers often discount thousands off MSRP, and the captive bank might offer a very low money factor to entice customers. Combine that with a solid residual value, and suddenly you’re looking at a surprisingly affordable monthly payment compared to financing the same car. This is a perfect example of how lease hacking shines—finding opportunities in cars that the buying market hasn’t fully embraced yet.

Deal Spotlight: $50,000+ Nissan Ariya for ~$162/Month

A LeaseHackr user was able to get a 2025 Nissan Ariya lease with the help of tons of incentives and a low money factor. (forum.leasehackr.com)

High incentives and dealer discounts, strong residual value, and a low money factor are a perfect recipe for a good lease deal.

Nissan Ariya

Final Thoughts

The moment you understand lease calculations, you flip the power dynamic. The numbers stop being a mystery and start becoming your greatest tool for savings.

Once you’ve mastered this, you’ll not only save money—you’ll also build the confidence to tackle any lease negotiation, no matter how complex it seems.

And remember: unlike most car leasing sites, LeaseFilter gives you access to residual values, money factors, and incentives that aren’t normally public. That means you’ll always have the full picture before you walk into a dealership, and you’ll always know exactly how to maximize your savings.

Want to skip the learning curve and get the best lease deals?

Sign up at LeaseFilter.com to instantly see exactly what you should be paying per month for any vehicle.

Not sure what vehicle you want to lease?

No problem, filter by the car attributes you want and we will show you the best deals for any vehicle with those attributes.

Using our email templates you can start reaching out to dealers, wait for a yes, and pick up the car, it's that simple.