How Lease Terms and Mileage Affect Your Monthly Payment: Data-Driven Analysis

9/17/2025

Ever wonder how lease term and mileage affect monthly payments?

So did we.

That’s why we used our data straight from LeaseFilter.com to analyze how term length and mileage impact monthly payments.

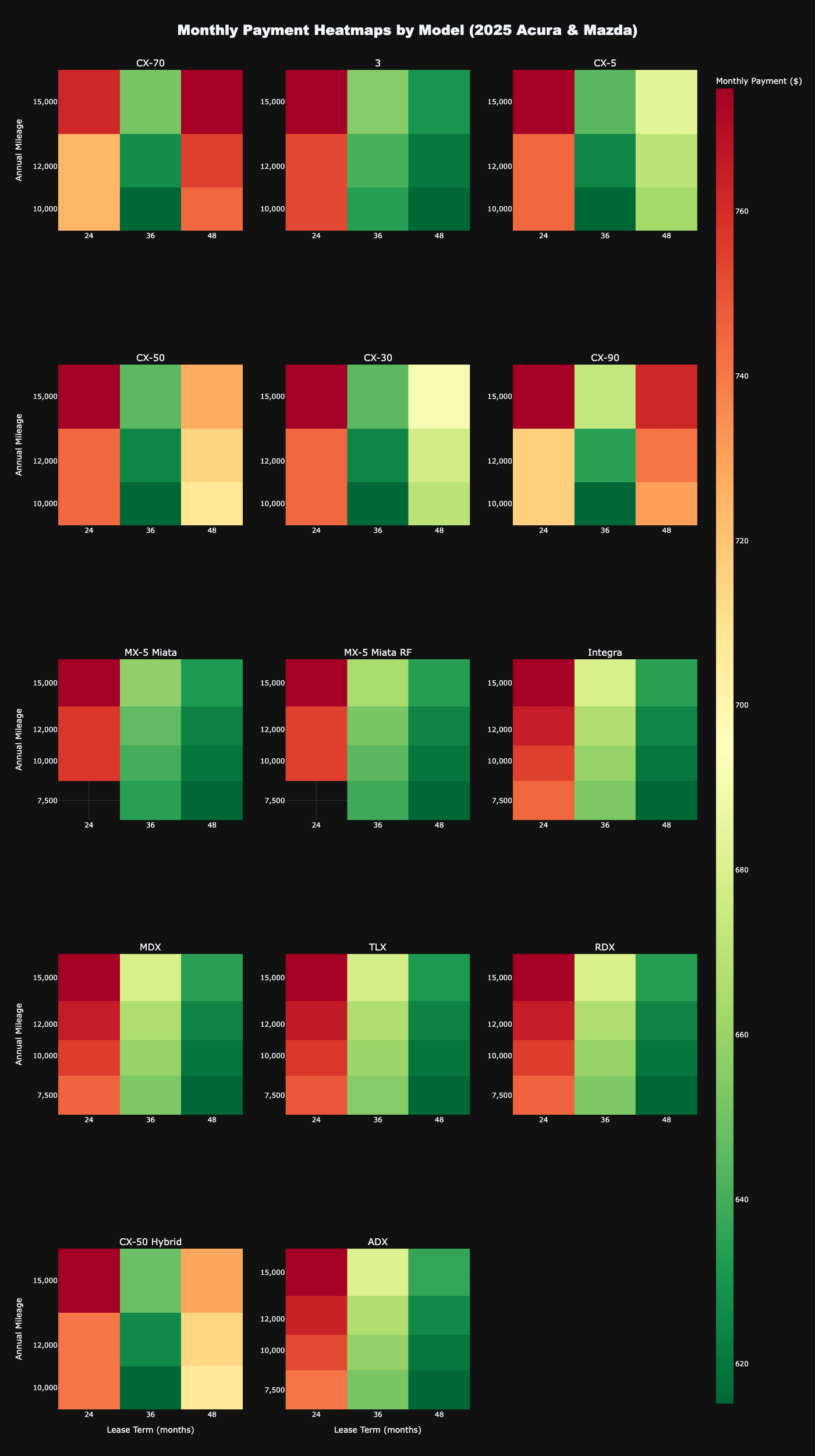

Heatmaps of monthly payment by term and mileage for 2025 Acura and Mazda models

Setup

For this analysis, we reviewed monthly payment data across 2025 Acura and Mazda models.

To keep things simple, no taxes, dealer fees, or documentation fees were included in the numbers. We also did not apply any discounts off MSRP.

The heatmaps show the average monthly payment across all trims, though results may vary trim by trim.

That means the monthly payments you see here are only rough estimates and shouldn’t be used to negotiate an actual lease. Instead, this is a clear, apples-to-apples way to understand how mileage and term length influence your monthly costs.

The Mileage Factor: Why More Miles Always Means More Money

Let’s start with the obvious: mileage always pushes the payment higher. The more miles you need, the more you’ll pay. That’s because higher mileage reduces the car’s residual value, meaning the leasing company expects more depreciation.

-

Cost per 1,000 miles: On average, we are seeing anywhere from a $5–$15 increase in your monthly payment per 1,000 miles for these makes.

-

Tip: Be honest about your driving habits. Overestimating mileage will cost you with a higher monthly payment, while underestimating may lead to expensive overage fees.

- In some circumstances, the overage fee is actually cheaper than paying for a higher-mileage lease. This is something we plan to add to LeaseFilter.com in the future!

Every heatmap shows the monthly payment increases (more red) with mileage

The Term Factor: Results May Vary

Here’s where things get interesting: the best lease term isn’t always the longest one.

Looking at the heatmaps, you’ll notice:

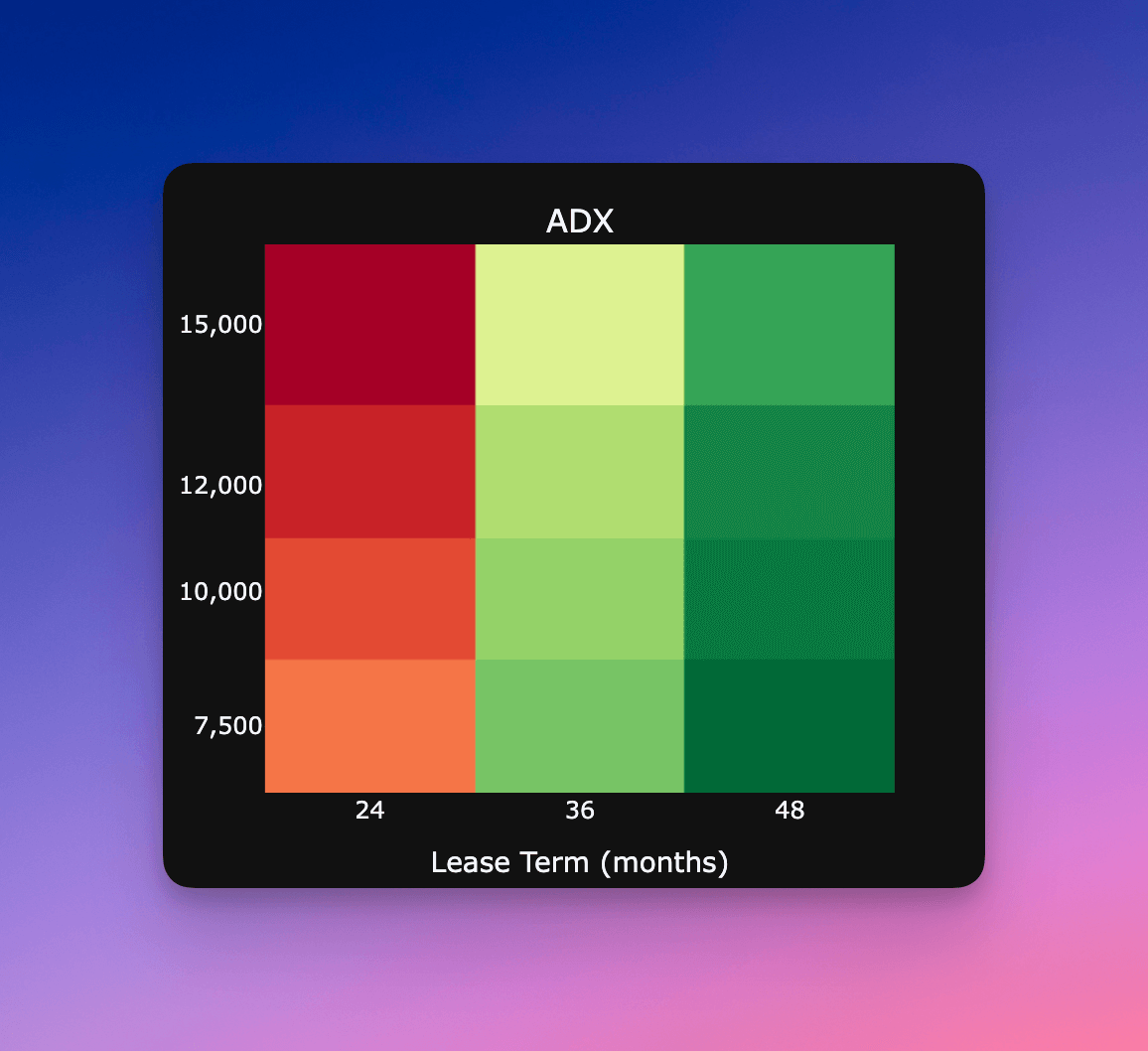

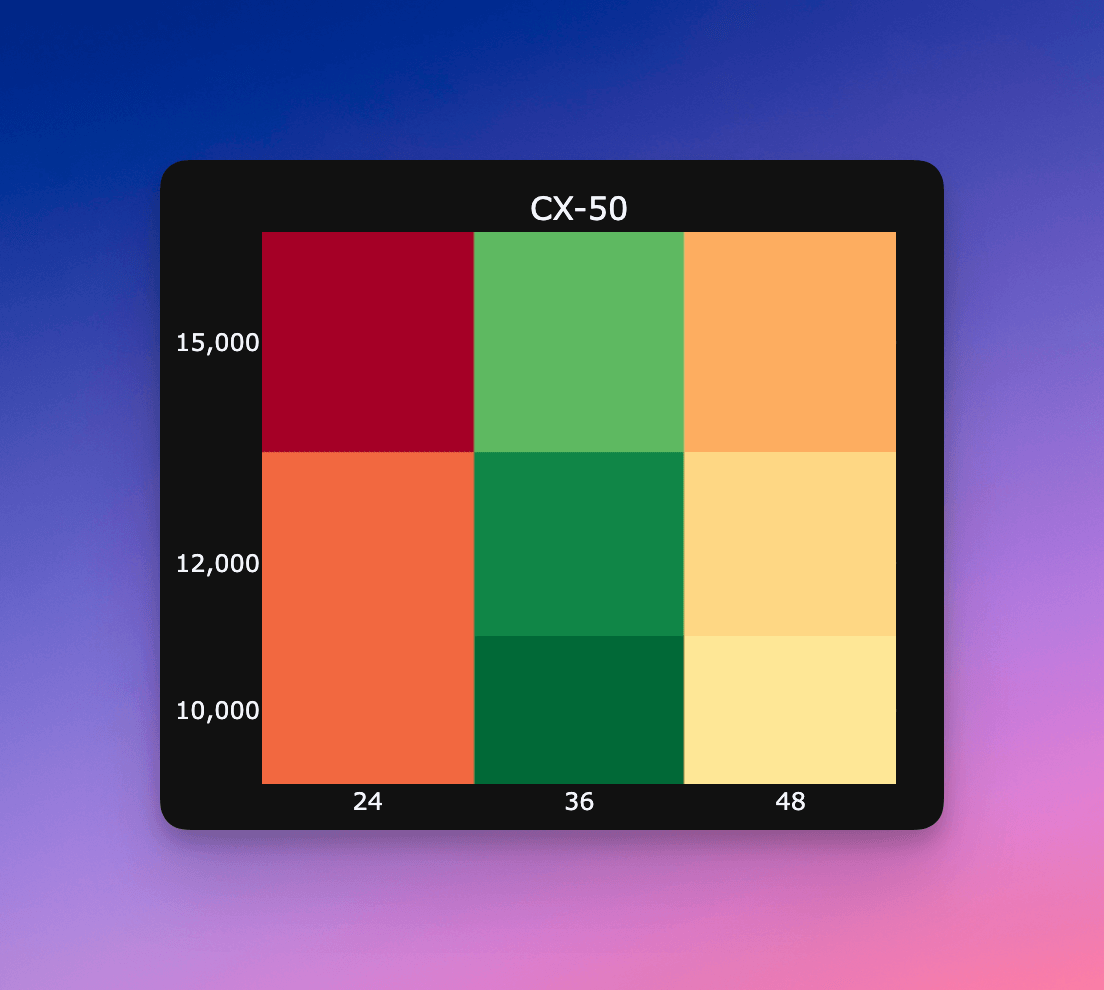

- Some models (like the Mazda CX-50) show the lowest monthly payments at 36 months.

- Others (like the Mazda 3 or Acura Integra) actually look cheaper at 48 months.

- Shorter 24-month terms always cost more per month for these makes, even though you’re paying for fewer total months.

This variation happens because lease programs are influenced by incentives, money factors (interest rates), and residual. All of which vary by model and lease term. It’s not a one-size-fits-all answer.

The 2025 Mazda CX-50 goes against the grain with the lowest monthly payment at 36 months

Breaking Down the Real-World Impact

2025 Mazda CX-30 Carbon Turbo

Imagine you’re deciding between a 36-month and 48-month lease on a 2025 Mazda CX-30 Carbon Turbo. Based on our data:

- 36 months @ 12,000 miles/year: Around ~$438/month.

- 48 months @ 12,000 miles/year: Closer to ~$493/month.

In this scenario, it’s a no-brainer to go with the 36-month lease:

- Lower monthly price

- Less maintenance burden

This is why I always recommend running the numbers for each term and balancing monthly savings against flexibility and maintenance risks.

How to Use This as a Leasehacker

If you’re serious about lease hacking, here’s the formula I use:

- Choose the minimum mileage you will actually need: Don’t dramatically overestimate. Overpaying for unused miles can cost hundreds of dollars over the course of a lease.

- Compare all available terms: Our data shows that longer terms generally mean lower payments, but not always. Also consider maintenance—shorter terms may let you avoid big-ticket services like new tires or major scheduled maintenance.

- Consider lifestyle changes: Think about how your needs may shift. For example, if you expect to need a bigger car in a couple of years, locking into a 48-month term may not be ideal.

Takeaway: Mileage Is Straightforward, Term Length Requires Strategy

The heatmaps confirm what we always suspected: mileage always raises costs, but term length is where hidden savings can be found. By using tools like LeaseFilter, you can instantly spot whether a 36-month or 48-month lease is the better deal and save even more.

👉 Are you tired of trying to learn how to lease hack and not sure where to start?

Check out LeaseFilter, the tool we built to make lease hacking seamless and save you thousands. Stop overpaying on your lease, if our tool even saves you $2 a month it's already paid for itself!